Last updated:

| 4 min read

Bitcoin’s market capitalization crossing the $1 trillion threshold represents a pivotal moment in its challenge against traditional assets like gold.

As Bitcoin price prediction becomes a hot topic among investors, the digital currency’s recent fluctuation to $51,940, a decrease of 0.70%, underscores the volatile yet promising potential of this asset class.

Recent developments, such as Celsius’ $2 billion disbursement to creditors and Coinbase’s $3.6 million donation to Bitcoin developers, alongside Justin Sun’s roadmap for a Tron-based Bitcoin Layer Two, signal a robust support system for Bitcoin’s infrastructure and investor sentiment.

These milestones not only highlight the growing acceptance and utility of Bitcoin but also set the stage for its long-term valuation and the intriguing possibilities that lie ahead in the cryptocurrency landscape.

Coinbase Supports Bitcoin Development with $3.6 Million Donation to Brink

Coinbase has made a substantial contribution to the Bitcoin community, donating $3.6 million to Brink, a nonprofit focused on supporting Bitcoin developers.

This generous donation, facilitated through Coinbase’s GiveCrypto program, aims to bolster open-source development on the Bitcoin blockchain.

Brian Armstrong, CEO of Coinbase, along with his team, received appreciation from Brink for their unwavering support, ensuring the grant comes with “no strings attached.”

Although Coinbase plans to wind down GiveCrypto, this move underscores the broader industry’s commitment to nurturing Bitcoin’s growth.

Brink is excited to announce a $3.6m donation to our #Bitcoin development funding efforts from GiveCrypto!

Thank you to @brian_armstrong and the @coinbase team as well as @johnhering and @FEhrsam for your support in making this happen!

— Brink (@bitcoinbrink) February 16, 2024

By enhancing Bitcoin’s scalability, security, and innovation, this investment seeks to boost investor confidence and potentially enrich Bitcoin’s value over time.

While the immediate effect on Bitcoin’s price may be subtle, strengthening the ecosystem’s foundation is expected to positively influence market sentiment and Bitcoin’s future stability.

Positive Long-Term Impact: Though immediate price effects may be minimal, strengthening Bitcoin’s ecosystem could favorably affect market sentiment.

Justin Sun’s Vision for Tron and Bitcoin Price

Justin Sun, the visionary behind Tron, is charting a new course for integrating Bitcoin Layer two solutions with the Tron network. This ambitious plan aims to revolutionize token operations within the Bitcoin ecosystem using advanced cross-chain technology.

By connecting various token types, including popular stablecoins USDT and USDC, directly to the Bitcoin network, Tron seeks to enhance decentralization and interoperability.

The roadmap unfolds in three strategic phases:

- Enhancing cross-chain connectivity

- Collaborating with Bitcoin Layer two protocols

- Deploying a comprehensive Layer two solution.

This initiative not only aims to rejuvenate Tron but also to enrich the Bitcoin community by bridging diverse digital assets. Following this announcement, Tron’s token (BTT) saw a notable 12% surge, indicating positive market reception.

While directly benefiting Tron’s ecosystem, such advancements could indirectly elevate Bitcoin’s appeal by broadening its use cases and fostering wider adoption across the crypto landscape.

Market Impact: This strategic move bolsters Tron’s position and potentially influences Bitcoin’s market dynamics, promoting broader crypto adoption.

Bitcoin Price Prediction

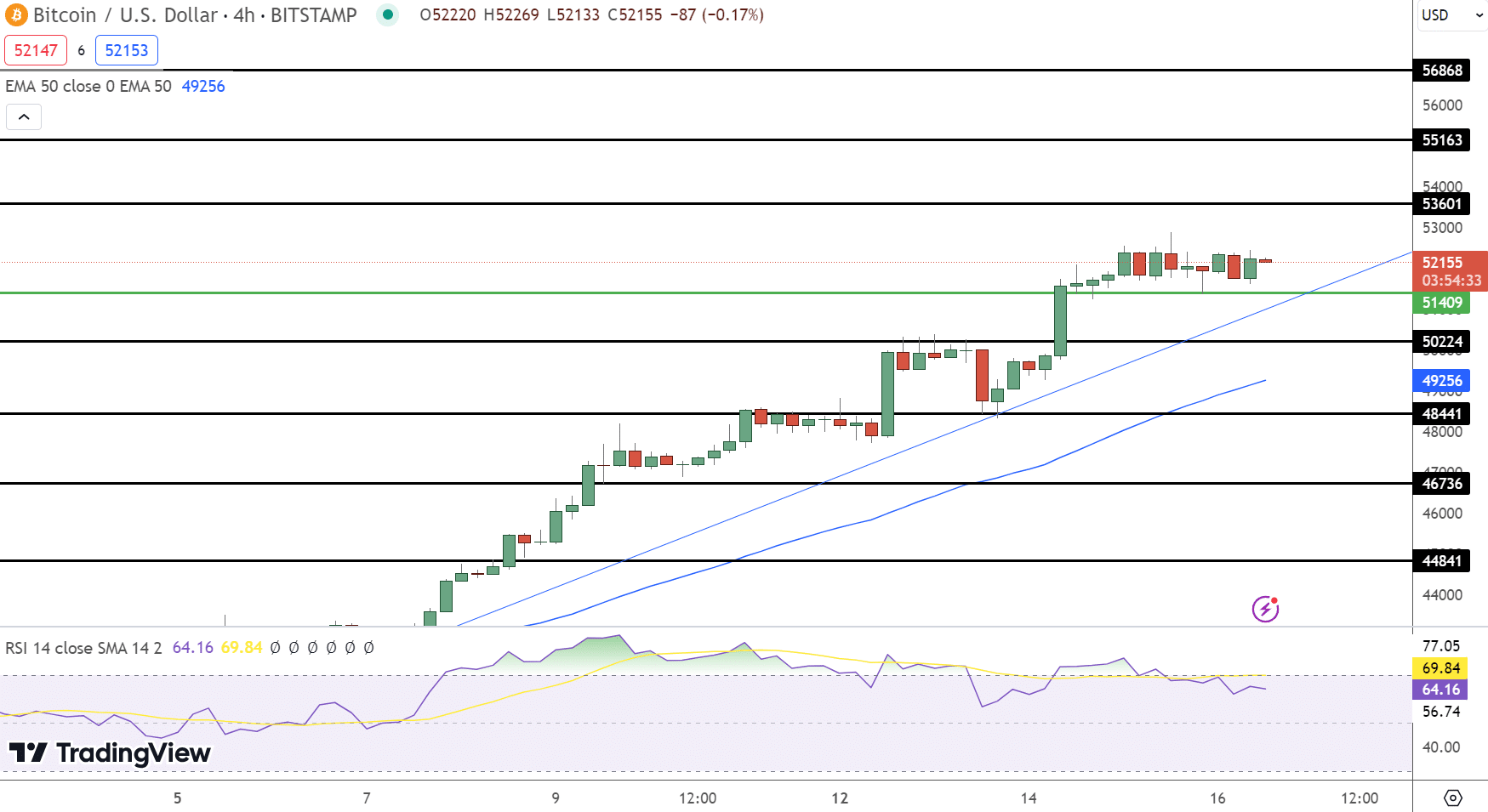

Bitcoin’s current technical outlook paints a picture of consolidation with key levels defining its short-term trajectory. The market’s immediate resistance lies at $53,601, with additional ceilings at $55,163 and $56,863.

Support levels are steadfast at $50,224, $48,441, and $46,736, which could provide a bounce-back in case of a price dip.

The Relative Strength Index (RSI) stands at 57.66, indicating neither overbought nor oversold conditions, suggesting a balance in market sentiment.

The 50-day Exponential Moving Average (EMA) at $49,732 offers bullish support, hinting at an underlying positive trend.

Chart analysis reveals a sideways trading channel between an upper boundary of approximately $52,740 and a lower boundary around $51,400.

The consolidation within this range suggests a cautious market, with potential for an upside breakout should the upper boundary be surpassed.

Currently, the market stance is bullish above the $51,400 level, and traders might look for this level to hold for confirmation of continued bullish sentiment.

Bitcoin Minetrix Edges Closer to Funding Target

Bitcoin Minetrix (BTCMTX), the Ethereum-based stake-to-mine platform, is on the brink of achieving its funding goal, with contributions now reaching $11,046,778.7 out of the targeted $11,850,888.

Here’s why Bitcoin Minetrix is garnering significant investor attention:

- The innovative platform enables users to earn Bitcoin by staking its native BTCMTX tokens.

- By staking BTCMTX, participants receive mining credits, unlocking Bitcoin hashing power.

- The unique model offers a dual-income opportunity: mining Bitcoin and accruing BTCMTX staking rewards.

- Bitcoin Minetrix’s intuitive approach is designed to draw individuals aiming for lucrative mining activities.

Currently, BTCMTX tokens are priced at $0.0135, but a price increase is imminent. Prospective buyers have a narrowing window—just over two days—to secure tokens at this rate on the Bitcoin Minetrix website.

With the funding nearly complete, Bitcoin Minetrix is nearing its strategic launch point, promising to amplify the mining and staking landscape.

Act now to be part of the Bitcoin Minetrix journey before the price escalates.