Last updated:

| 2 min read

Cardano (ADA) has recently demonstrated remarkable resilience, overturning its previous downtrend to secure a 16% increase, settling at $0.52 after a brief descent to $0.43 on January 23.

This fluctuation was primarily attributed to the broader market’s reactions to the BTC ETF approval, casting a shadow of uncertainty over the crypto landscape.

Yet, Cardano’s robust recovery to $0.50 by January 27, fueled by optimistic market sentiment and the Federal Reserve’s steady interest rates, hints at a potential surge towards the $0.60 mark.

U.S. Economic Strength Boosts Dollar, Weighs on Cardano

The recent U.S. economic data indicating strong employment growth and rising consumer sentiment has bolstered the dollar, creating a challenging environment for cryptocurrencies like Cardano (ADA).

The increase in average hourly earnings to 0.6% and a robust non-farm employment change of 353K signal a potentially tighter monetary policy to curb inflation, strengthening the dollar.

⚠️BREAKING:

*U.S. NONFARM PAYROLLS +353,000; EST. +187,000

*U.S. UNEMPLOYMENT RATE 3.7%; EST. 3.8%*U.S. AVERAGE HOURLY EARNINGS RISE 0.6% M/M; EST. 0.3%

*U.S. AVERAGE HOURLY EARNINGS RISE 4.5% Y/Y; EST. 4.1%🇺🇸🇺🇸 pic.twitter.com/WS038Rj3lX

— Investing.com (@Investingcom) February 2, 2024

A stronger dollar typically exerts downward pressure on cryptocurrencies, as it enhances the appeal of holding fiat currency over digital assets.

Consequently, despite the optimistic economic indicators, Cardano may face headwinds as the strengthened dollar could deter investment in ADA, potentially impacting its price trajectory negatively.

Cardano Price Prediction

Cardano (ADA has experienced a nearly 4% increase in the last 24 hours, reaching $0.508, with a trading volume of approximately $422.6 million.

Ranked #8 by market capitalization, Cardano boasts a valuation of about $18.01 billion, emphasizing its prominence in the crypto market with a circulating supply of 35.43 billion ADA, out of a total 45 billion.

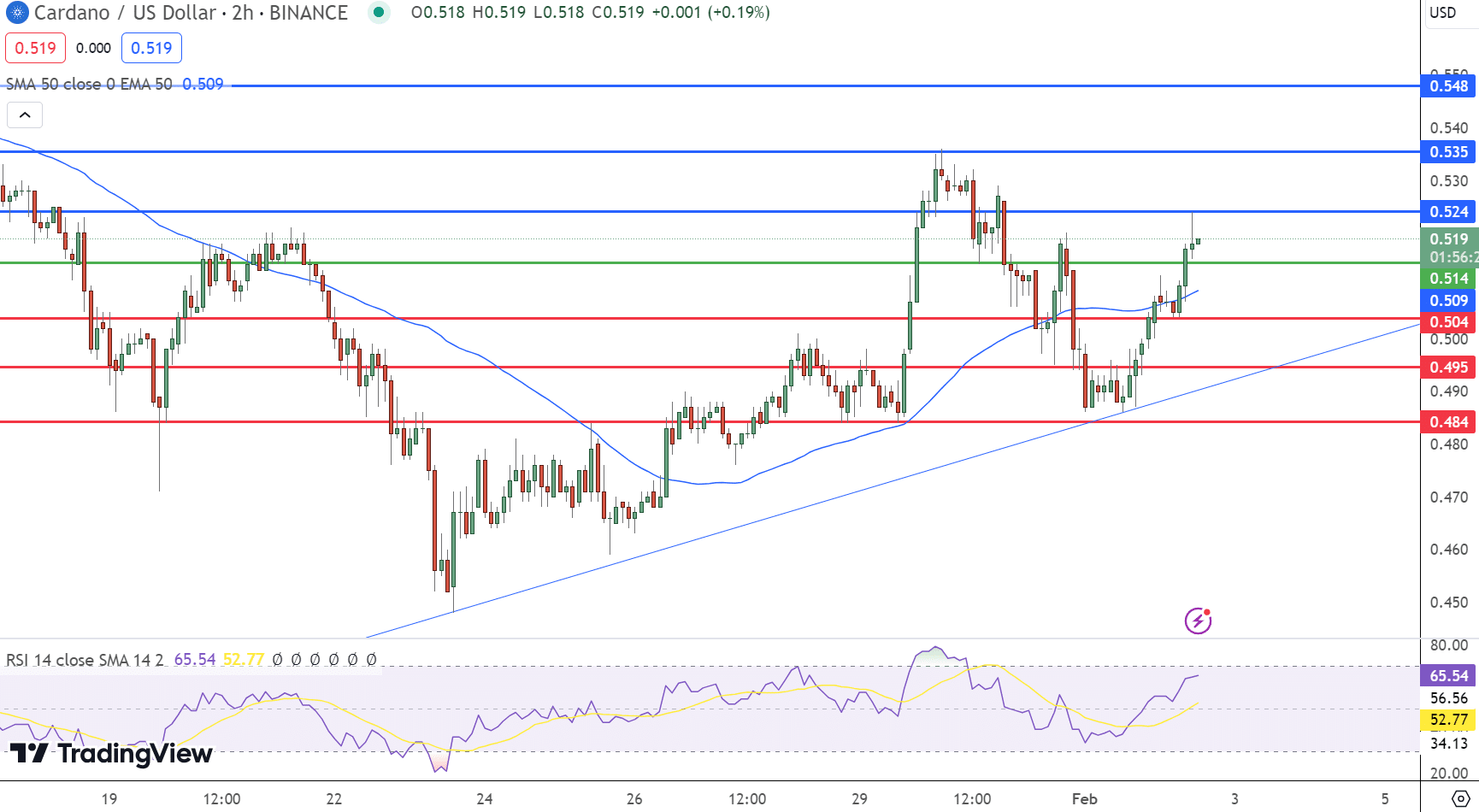

In the 4-hour chart analysis, the pivot point is marked at $0.514, indicating a potential shift in momentum. Resistance levels are identified incrementally at $0.524, $0.535, and $0.548, suggesting upward barriers.

Support, conversely, is found at $0.504, with further levels at $0.495 and $0.484, marking zones of buyer interest.

Technical indicators reinforce the bullish sentiment, with the 50-day Exponential Moving Average (EMA) at $0.509 and the Relative Strength Index (RSI) at 65, both signaling a robust buying trend.

Cardano’s current trajectory is bullish, particularly above the $0.509 mark, underscoring a positive outlook for ADA as it navigates through key technical levels.

Bitcoin Minetrix Presale Soars to $10.1 Million Amid Surging Crypto Interest

Bitcoin Minetrix (BTCMTX), a revolutionary stake-to-mine platform, is carving out a significant niche for itself in the presale phase, with contributions soaring beyond $10.10 million. This surge in interest is a testament to its innovative approach to Bitcoin mining, slated for an eagerly awaited launch in the upcoming year.

Bitcoin Minetrix distinguishes itself by enabling users to mine real Bitcoin through staking its native BTCMTX tokens, thereby democratizing the mining process. As the momentum of the presale escalates, the current valuation of BTCMTX tokens stands at $0.0132, hinting at an imminent price uptick as the official launch date approaches.

The presale has thus far amassed $10,134,443, edging closer to its target of $10,326,940, underscoring the robust investor confidence in the Bitcoin Minetrix project.