Today's Cryptocurrency Prices by Market Cap

Coins HD ranks and scores coins based on marketcap, trading volumes, and price.

| # | Name | Price | Changes 24H | Changes 7D | Changes 30D | High 24H | Low 24H | Market Cap | Volume 24H | Price Graph (7D) |

|---|

We Asked ChatGPT if Solana (SOL) Price Will Reach $200 This Year

TL;DR Solana’s recent surge: Trading around $60, up 40% in a week and 300% yearly, making it the 6th largest cryptocurrency with over $25 billion market cap. Price influencers: Factors…

Failed Crypto Lender Hodlnaut Ordered Into Liquidation

Upon the crash of Terra’s ecosystem a year and a half ago, the ripple effects harmed many digital asset companies in one way or another. Crypto lenders, such as BlockFi,…

Here’s How Much Ripple (XRP) Was Stolen in the Poloniex Attack

TL;DR Poloniex Hack: Cryptocurrency exchange Poloniex was hacked on November 10, losing $125 million in various cryptocurrencies from its hot wallets, including 3.1 million XRP tokens. Widespread Token Impact: Over…

FTX Bankruptcy Team Sues Crypto Exchange Bybit for $1 Billion – What’s Going On?

Source: Adobe / Ascannio FTX’s bankruptcy advisers have filed a lawsuit against crypto exchange Bybit Fintech and its two affiliated companies. The lawsuit aims to recover approximately $953 million worth of…

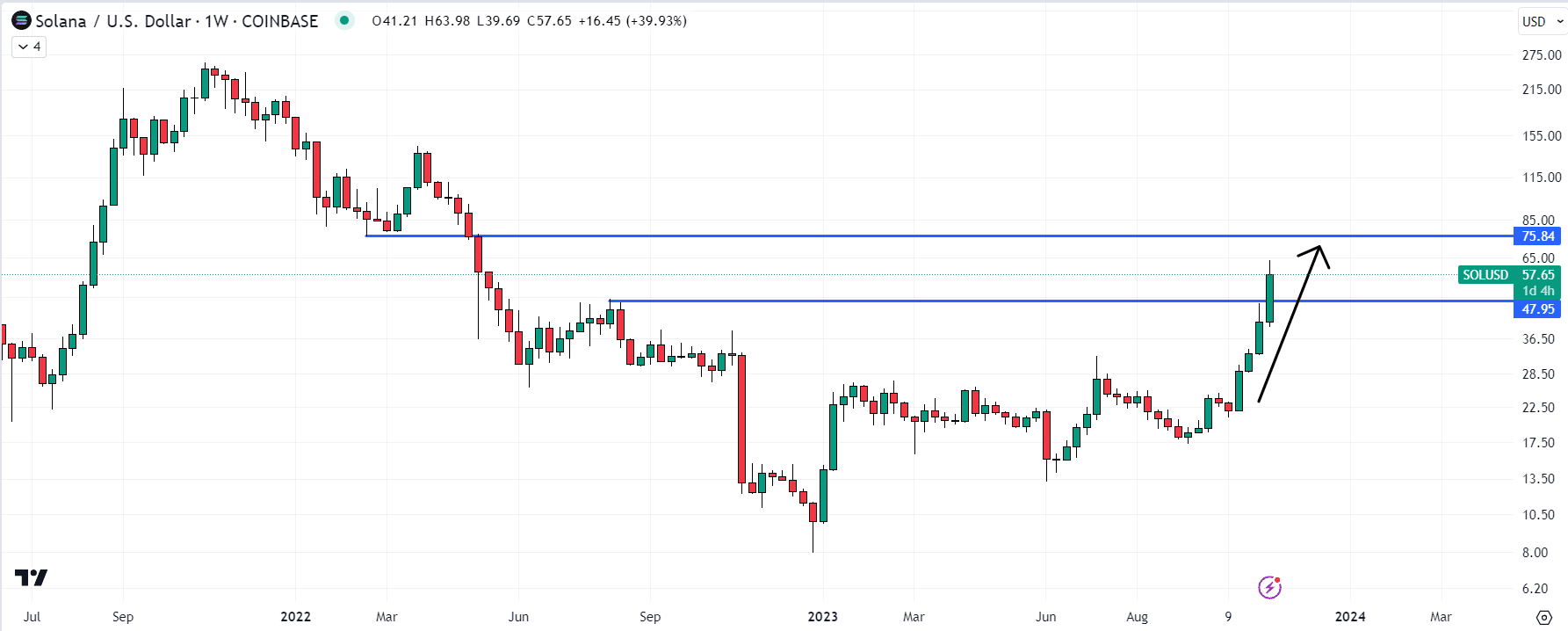

Solana Price Prediction as SOL Blasts Through Resistance at $47.50 – $100 SOL Incoming?

Solana (SOL) Chart / Source: TradingView The price of Solana (SOL), the cryptocurrency that powers the high-performance, smart-contract-enabled Solana layer 1 blockchain protocol, continues to melt higher on Saturday, taking…

DeFi Platform Raft Hacked for $3.3 Million, Attacker Burns Most of Stolen ETH – Here’s What Happened

Source: Pixabay Decentralized finance (DeFi) platform Raft has suffered a hack resulting in the loss of approximately $3.3 million in Ethereum ( ETH). However, the attacker’s attempt to profit from…

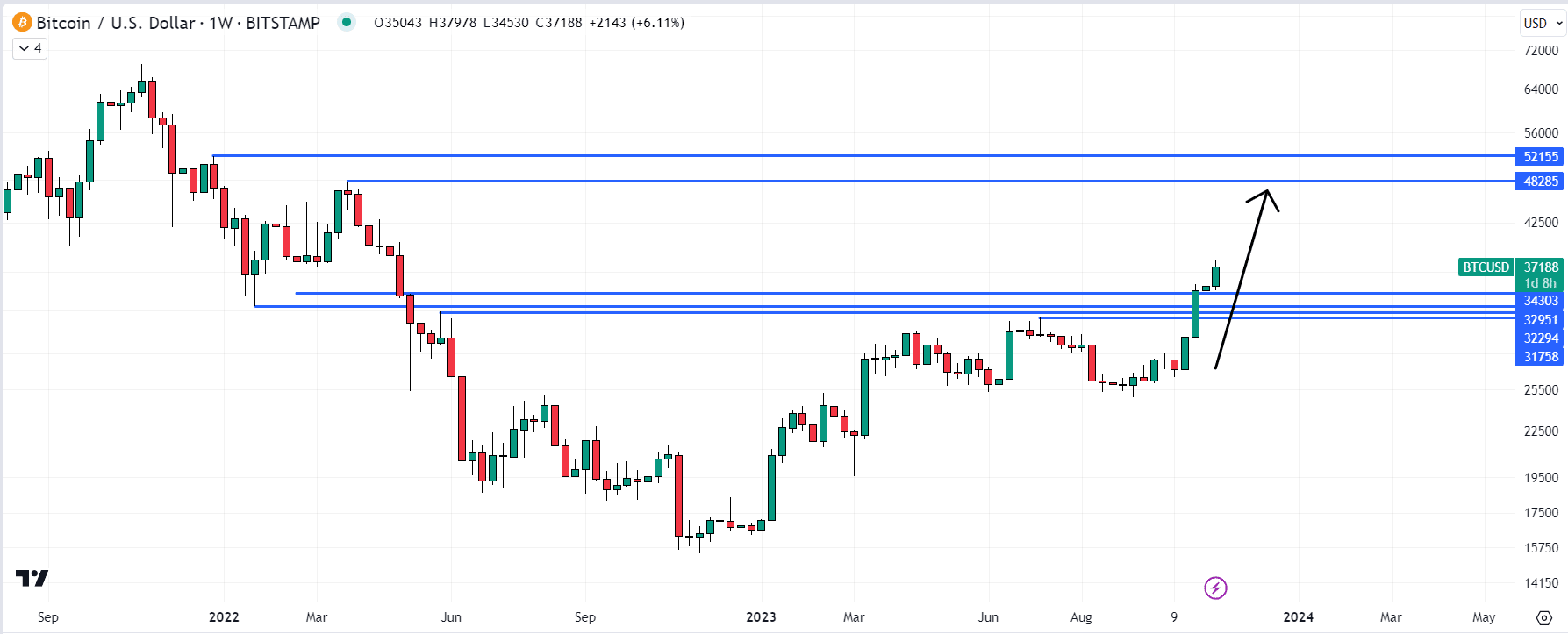

Bitcoin Price Prediction as $20 Billion Sends BTC Toward $40,000 – Has the Bull Market Started?

Bitcoin (BTC) Chart / Source: TradingView The Bitcoin (BTC) bulls are taking a breather on Saturday, with the cryptocurrency moving sideways just below the yearly highs it printed earlier this…

High Court Orders Liquidation of Hodlnaut Crypto Lending Platform – 17,000 Users Impacted

Source: Hodlnaut The Singapore High Court has ordered cryptocurrency lending platform Hodlnaut to undergo liquidation, as stated in a court document dated November 10. The court has appointed Aaron Loh Cheng Lee…

Six-Figure Prices for Bitcoin Rock Ordinals and EtherRock NFTs Reignite Hopes for Return of NFT Mania

$100k+ Sales of EtherRock NFTs and Bitcoin Rock Ordinals Stoke Speculation of an NFT Revival. Image by Garrett, Adobe Stock. Nonfungible tokens (NFTs) are back in the spotlight this week…

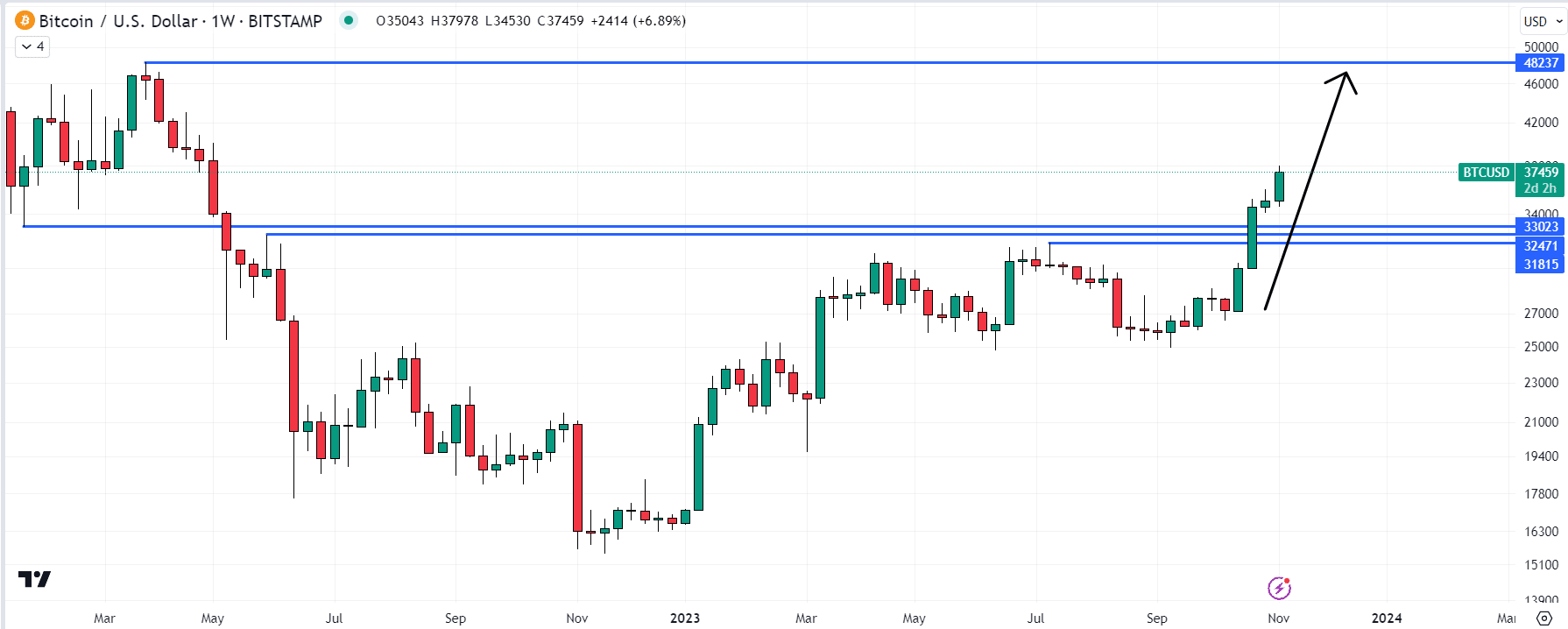

Bitcoin Price Prediction as BTC Market Cap Climbs Above $700 Billion for the First Time in 17 Months – Bull Market Back?

Bitcoin (BTC) Chart / Source: TradingView A near 8% surge in the price of Bitcoin (BTC) in the past seven days has seen its market capitalization jump by more than…

What is Crypto Market Cap?

Cryptocurrency market capitalization, often referred to as “crypto market cap,” represents the combined worth of all issued coins for a specific cryptocurrency. It’s a pivotal metric used to gauge the relative size of a cryptocurrency in the market. A cryptocurrency’s market cap is derived by multiplying its current price with the total number of its coins that have been mined or are currently in circulation. For example, to determine Ethereum’s market cap, simply multiply its current price by the total circulating Ethereum coins. A higher market cap indicates a more significant market presence and influence of that particular cryptocurrency.

How to compare Cryptocurrencies Market Cap?

Cryptocurrencies, based on their market capitalization, can be segmented into three primary tiers:

Large-cap Cryptocurrencies: Valued at over $10 billion, these are the giants of the crypto world. Examples include Bitcoin and Ethereum. These coins are characterized by their established presence, widespread adoption, and a robust ecosystem. They often have a strong community of developers who not only maintain and refine the existing protocol but also innovate by building new projects atop these platforms.

Mid-cap Cryptocurrencies: These fall between $1 billion and $10 billion in market cap. They might not be as established as the large-cap coins but have shown potential for growth and have garnered a significant amount of attention and investment. Their ecosystems are growing, and they often represent newer technologies or unique value propositions in the crypto space.

Small-cap Cryptocurrencies: Valued at less than $1 billion, these are the emerging players. While they offer high-reward potential due to their lower valuation, they also come with increased risks. Their ecosystems might still be in the nascent stages, and they could be more susceptible to market volatility.

When comparing cryptocurrencies using market cap, it provides a straightforward way to gauge their relative sizes and standings. However, it’s crucial to approach this metric with caution. Some cryptocurrencies might exhibit inflated market caps due to aggressive price movements or the structure of their token supply. Therefore, while market cap serves as a useful reference point, it’s essential to complement it with other indicators like trading volume, liquidity, the fully diluted valuation, and a thorough analysis of the project’s fundamentals. This holistic approach ensures a more informed and balanced perspective when evaluating cryptocurrencies.