Last updated:

| 3 min read

The Bitcoin (BTC) price has tumbled more than 6% from the mid-$46,000s to the mid-$43,000s, as the post-spot Bitcoin ETF “sell-the-fact” reaction comes in.

The US SEC approved the launch of the first 11 spot Bitcoin ETFs on Wednesday.

Trade in the new Bitcoin investment products went live on Thursday and was a big success.

As per LSEG data cited by Reuters, the new spot Bitcoin ETFs saw $4.6 billion in trading volumes on Thursday.

Higher-than-expected demand helped propel the Bitcoin price to fresh two-year highs above $49,000 at the time.

But the Bitcoin price has since succumbed to a wave of profit-taking.

When the Bitcoin price high $49,000 on Thursday, that took its spot Bitcoin ETF optimism-fuelled rally in the past five months to a staggering 90%.

Some analysts had warned that this rally left the market vulnerable to a profit-taking-fuelled pullback, or a so-called “sell-the-fact” reaction.

Friday’s bearish price action suggests that this sell-the-fact reaction is starting to come in.

Reports that Bitcoin miner outflows to exchanges has hit a six-year high might also have upset the market.

Miners need to periodically send their BTC to exchanges to sell in order to fund their mining costs.

CryptoQuant analyst Bradley Park told the crypto press that mining pool F2Pool was behind much of the recent outflows.

He noted that F2Pool may be selling coins to fund miner upgrades ahead of the halving.

How Low Can the Bears Push the Bitcoin (BTC) Price?

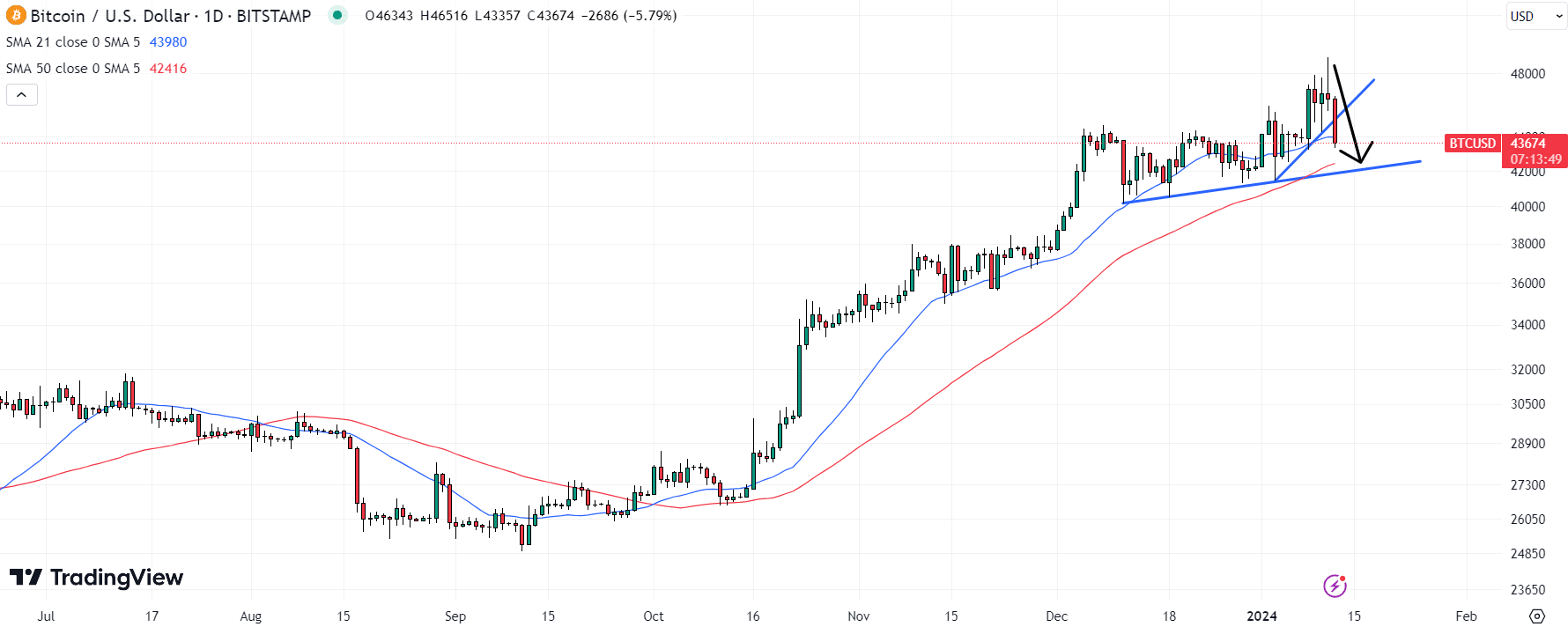

The Bitcoin price’s latest dive has seen it break below a one-week uptrend.

BTC is currently probing for a break below its 21DMA, which sits at $44,000.

A convincing break below here would open the door to a test of the 50DMA at $42,400, and an uptrend from December.

But risks are titled towards an even bigger dip in the Bitcoin price.

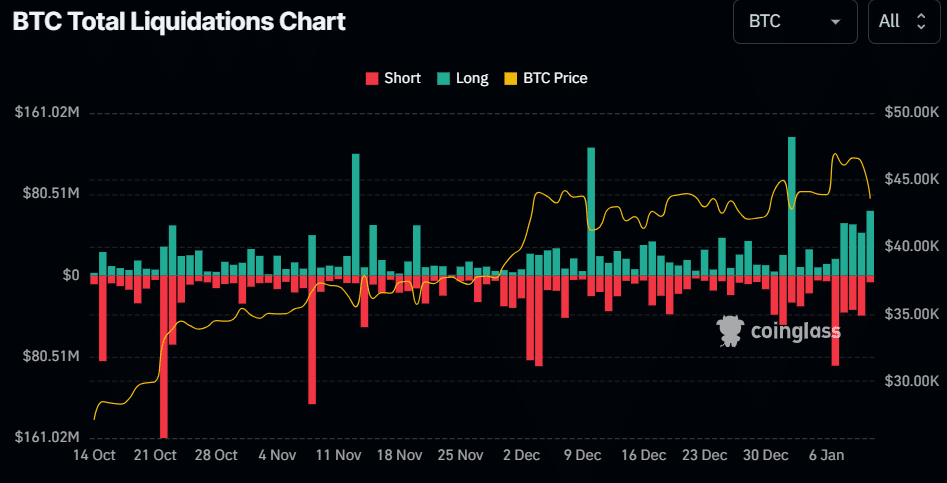

Data presented by coinglass.com shows that the latest price drop hasn’t been fuelled by speculators getting liquidated.

As per the derivatives analytics website, $64 million worth of leveraged long Bitcoin futures positions were stopped out on Friday.

That’s much smaller than recent long liquidation events, such as on the 2nd of January and 10th of December.

The risk is that as the price continues to decline, the fall is accelerated as long-position liquidations rise.

Futures open interest at two-year recently pumped to fresh two-year highs above $19.5 billion.

High participation in the Bitcoin derivatives market by speculators suggests the price remains at a high risk of liquidation event-fuelled volatility, including to the downside.

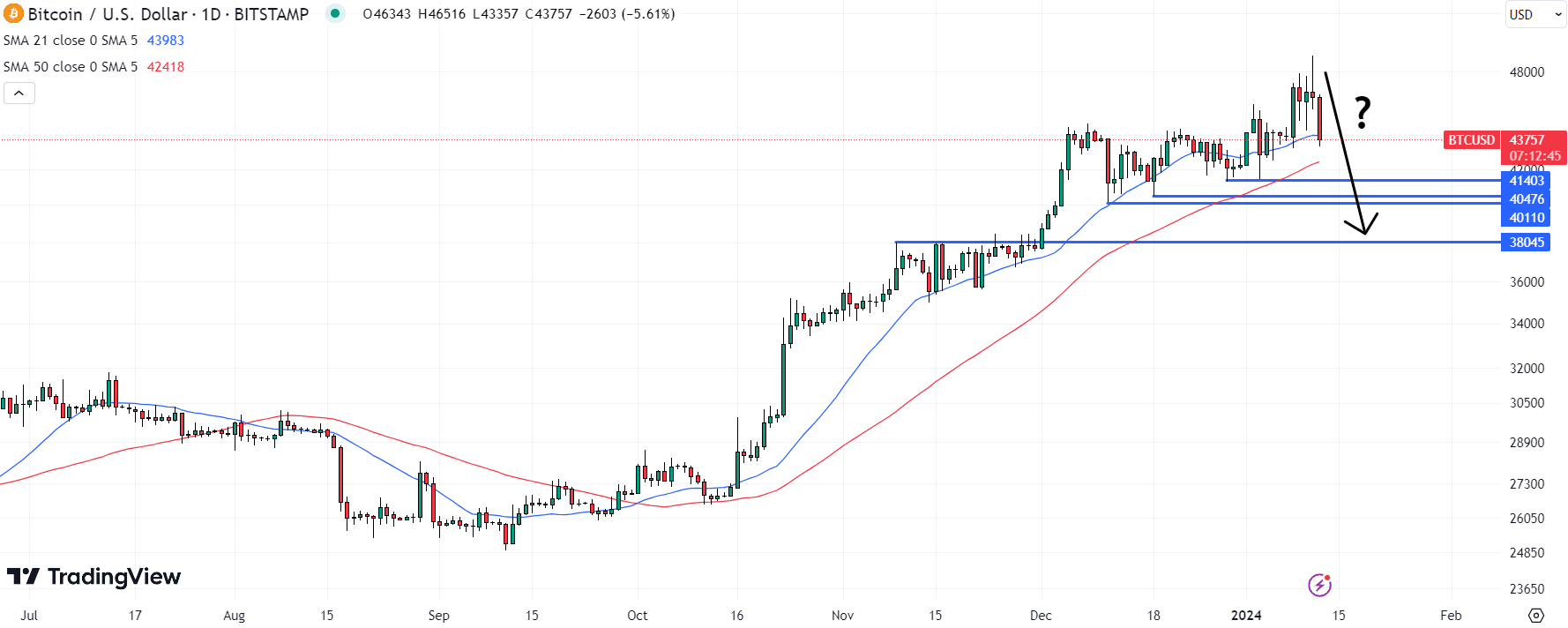

If Bitcoin fell below December support levels between $40,000 and $41,500, things would really get interesting.

While a return to sub-$40,000 levels is possible, it’s questionable as to how long the Bitcoin price would remain at these levels.

Here’s Why Bitcoin Bulls Will Buy the Dip

Bitcoin ETF demand and an upcoming Fed cutting cycle are expected to provide long-term support to the Bitcoin price.

Meanwhile, reduced supply once the Bitcoin halving takes place in April is also likely to provide long-term tailwinds.

Bitcoin continues to almost perfectly track its usual four-year market cycle.

BTC has historically rallied for around three years following each year-long bear market.

Each of these rallies has historically seen the Bitcoin price blast past its prior record highs.

14 months on since its price bottomed around $15,000 in November 2022, Bitcoin is well on its way back to its 2021 highs around $69,000.

But if history is any guide, this bull market could see the Bitcoin price easily surpass $100,000 within the next 22 months.

Historical patterns plus the aforementioned cocktail of positive fundamentals mean that dip buying demand for BTC will likely remain strong.

As a result, the bears are unlikely to be able to push the Bitcoin price substantially below $40,000.